How to Use U.S Property Records to Glean Insight into Offshore Entities

Shell companies registered in secrecy jurisdictions continue to present a myriad of obstacles to financial institutions conducting due diligence, multinationals performing third party KYC checks, and law enforcement agencies investigating complex money laundering schemes. Luckily, U.S. property records can sometimes provide investigators unfettered access to the real identities behind these companies.

Criminal groups and other bad actors have long been known to launder their illicit proceeds through U.S. real estate. While criminals or their proxies may own the property outright, property ownership in laundering schemes is often conducted through a corporate vehicle to provide a layer of secrecy.

In such cases, the beneficial owner and/or controller of the property may be hidden via multiple nested layers of corporate ownership, ultimately leading to an offshore entity in a secrecy jurisdiction, such as the British Virgin Islands, Delaware, or Barbados.

We should note that owning property through an offshore entity is perfectly legal; and by no means is the ownership of property through companies registered in secrecy jurisdictions in and of itself a sign of criminal activity.

Find out whether the company of interest owns property

Identifying whether an entity of interest owns real property in the U.S. is the first step to potentially unmasking the people behind that entity.

This information can often be found by simply querying the entity in question on the open web. Oftentimes, entities that own property will appear in real estate and/or property aggregators.

Additionally, you can use commercial property search databases such as Property Shark, which allows users to search for property by address or owner, as well as see historical ownership.

Consult county property registers

Once you’ve identified the address where the entity of interest may own property, consult the county property register for the county in which it is located.

It is important to note that the amount of data provided in each county’s property register can vary greatly. While some, like Miami-Dade County, Florida, and Harris County, Texas, provide free access to detailed property records, others may provide much less information.

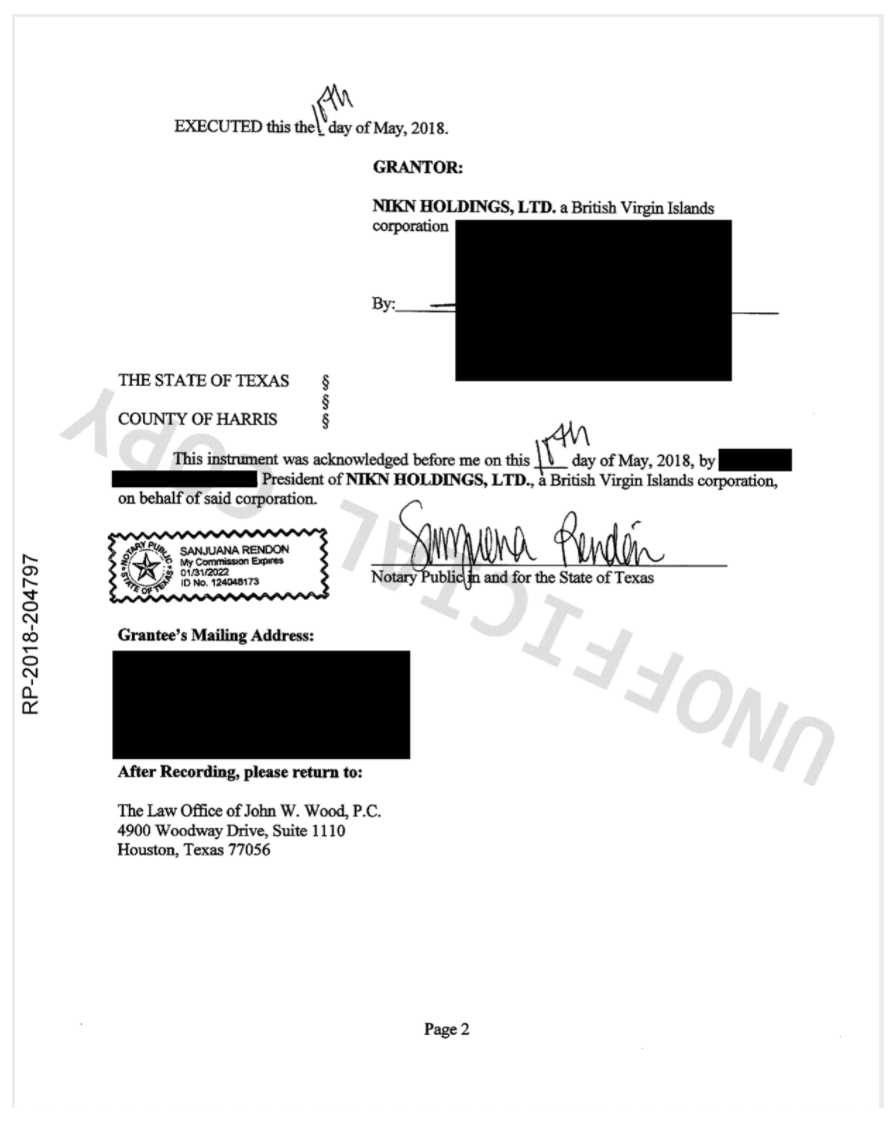

Original filings for warranty deeds and other property-related documents, will sometimes provide the name of an officer or legal representative of the offshore company purchasing or selling the given property, thus allowing investigators to link a natural person to the offshore entity.

Fig. 1: A snapshot from a general warranty deed for the sale of property from an entity registered in the British Virgin Islands.

Alternative Methods

There are additional open-source techniques to identify the natural person that ultimately owns or controls an entity in an offshore tax haven.

One method is by looking for the registration of the offshore company in a jurisdiction that discloses more information (e.g. a Delaware LLC that registers to do business in Florida). Another is by getting creative with search operators to potentially find the offshore entity on a corporate document in another jurisdiction that discloses the beneficial ownership/control information for the entity.

All of the aforementioned techniques can be used across the globe and are not restricted to any one particular jurisdiction.